Indirect Taxation

Goods & Service Tax (GST)

Goods and Services Tax (GST), in simple words, means instead of paying taxes at every level in the form of VAT, excise duty, sales tax, customs, luxury tax, and service tax, you pay a single tax at the end of the supply chain.

GST Registration

In order to supply goods and products in India, it is mandatory to do GST registration.

Registration ensures safe taxation and also lets you enjoy various benefits. Multiple input taxes are paid at every stage of build-up and interaction with tax authorities. This can be avoided by adding value for each stage and a final tax being paid by the customer to the last dealer from whom the product is being bought or services were taken.

GST Registration Process

1. Arrange all required documents

All required documents must be ready – According to the document checklist, the relevant documents have to be submitted.

2. Application filing and response

Make an application, file it and wait for a response – The documents and application form GST form Reg 1 will be filed and a response will be awaited for at least 3 days.

3. GST registration & Compliance

If the filed documents and application form are approved then the GST registration certificate will be granted. Quarterly monthly returns have to be filed hereafter.

GST Exemption & Remedies

This rule lays down that GST registration is a must for a supply of goods or services that incur the value of 20 lakhs or more and the registration has to be applied for within 30 days. The following states namely Jammu and Kashmir, Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Himachal Pradesh, Uttarakhand, Sikkim, Tripura, and Nagaland will be exempt from this rule and the cut off for these states is 10 lakhs and beyond.

Mandatory GST Registration Cases

- In spite of any exemption or remedies, the following cases will need GST registration compulsorily even if turn-over is less.

The person making any inter-state taxable supply. - The casual taxable person making any taxable supply.

- Persons who are required to pay tax under Reverse Charge.

- The non-resident taxable person making any taxable supply.

- Every person providing online information database access from outside India – AWS, Godaddy, etc.

- Person supplying goods/services on behalf of someone else (agent).

- Input service Distributor – Whether or not register.”

- The person selling on an e-commerce platform like Flipkart, Amazon, etc.

- Every e-commerce operator – Flipkart, amazon, snapdeal, etc.

- Persons who are required to deduct TDS (Govt Departments).

- Anything else notified by the Government from time to time.

Cases of GST Exemption

There are only two cases where GST registration is not required at all even if the turnover is more than 20 lakh. The two cases are as follows:

1. Exempted Goods

Any supplier of goods or services that are exempt from being taxed or can’t be taxed even if the turnover is more than 20 lakhs.

2. An agriculturist who supplies produce cultivated on land

An agriculturist cultivates land by himself or by employing others is also exempt from GST if he supplies the land produce.

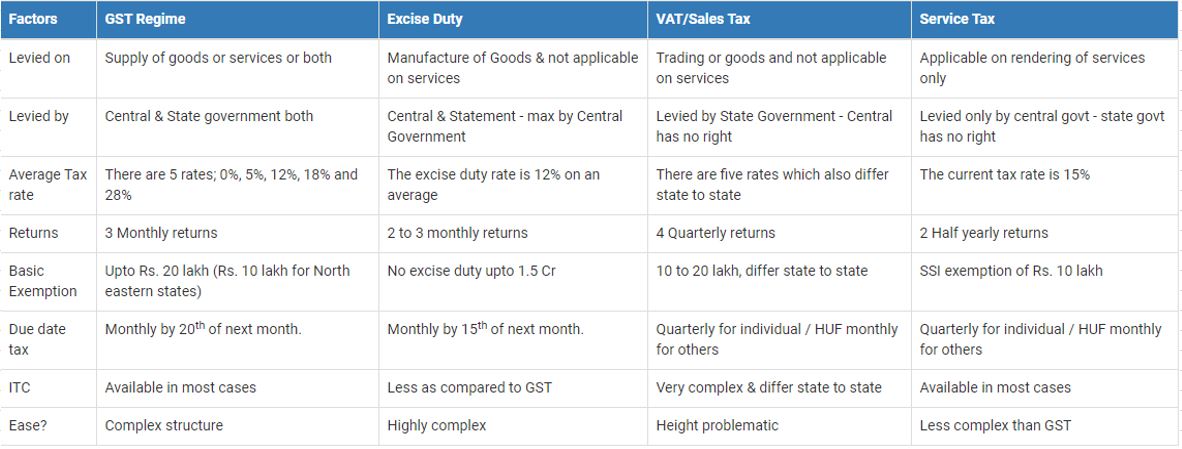

Difference between GST, Excise, VAT/Sales Tax, and Service tax

Let us discuss some of the most important differences between the existing excise duty, VAT/sales tax, service, and new GST.

Compliances after GST Registration

There are so many compliances under GST and if not complied properly, then there is a provision of high penalties. Here are three main compliances:

1. Invoices

Invoices should be uploaded on GSTN and reference numbers must be generated before the supply is made.

2. Three Returns

GSTR 1, 2, 3 are the 3 monthly returns that must be filed according to the uploaded invoices.

3. Annual

An annual return has to be filed as well.

To know about Audit & Assurance click on this link